Introduction: Understanding the Value of Passive Income Ideas to Make Money

In a world where financial independence and security are more sought after than ever, passive income ideas to make money have emerged as a key strategy for diversifying earnings and building wealth. Whether you’re aiming to supplement your income or create a financial cushion for unexpected challenges, passive income offers opportunities to achieve your goals with less ongoing effort. This comprehensive guide to 16 passive income ideas in 2025 will empower you to make informed choices for sustainable earnings.

What is Passive Income?

Passive income refers to earnings generated from sources outside your primary job or active labor. According to the IRS, common examples include income from rental properties, dividends, or royalties. Contrary to the notion of “effortless wealth,” passive income often requires initial investment—whether it’s time, money, or expertise—to set up and maintain. However, the payoff can lead to long-term financial freedom.

A key distinction is that passive income doesn’t stem from direct involvement, such as working a second job or relying on non-income-producing assets. For instance, dividend-paying stocks qualify, while non-dividend stocks or cryptocurrencies do not. Understanding these nuances is essential for crafting a reliable passive income strategy.

Passive Income Ideas to Make Monay for Creatives

1. Write an eBook

Leverage your expertise to create an ebook on a niche topic. Platforms like Amazon Kindle Direct Publishing enable you to reach a global audience with minimal upfront costs. Short ebooks (3050 pages) can provide high value to readers seeking targeted knowledge. Experiment with different titles and price points to maximize appeal. Publishing multiple ebooks can snowball your earnings.

Opportunity: Create once, and sell indefinitely to a global market.

Risk: High competition; requires marketing to gain visibility.

2. Sell Photography Online

If you have a knack for photography, selling stock images on platforms like Shutterstock, Getty Images, or Alamy can yield recurring income. Focus on specific themes or styles in demand, such as landscapes, lifestyle shots, or news events. Licensing agreements allow you to earn each time a customer uses your photo.

Opportunity: Scalable income through repeated sales of the same photo.

Risk: Requires initial approval and consistent quality to meet platform standards.

3. Create an App

Designing an app, whether a utility tool or an engaging game, can provide long-term passive income. After the initial development, revenue can be generated through in-app purchases, ads, or subscriptions. Ensure your app solves a specific problem or provides unique entertainment.

Opportunity: High earning potential through scalable user engagement.

Risk: High initial time investment; technical expertise required.

4. Start a Blog of your passion or expertise or YouTube Channel

Share your knowledge or passion through a blog or your YouTube channel. By monetizing your platform with ads, affiliate links, or sponsorships, you can create a sustainable income stream. Identify a niche, create engaging content, and build a loyal audience over time.

Opportunity: Low startup costs; unlimited earning potential.

Risk: Time-intensive; requires consistent content creation and audience engagement.

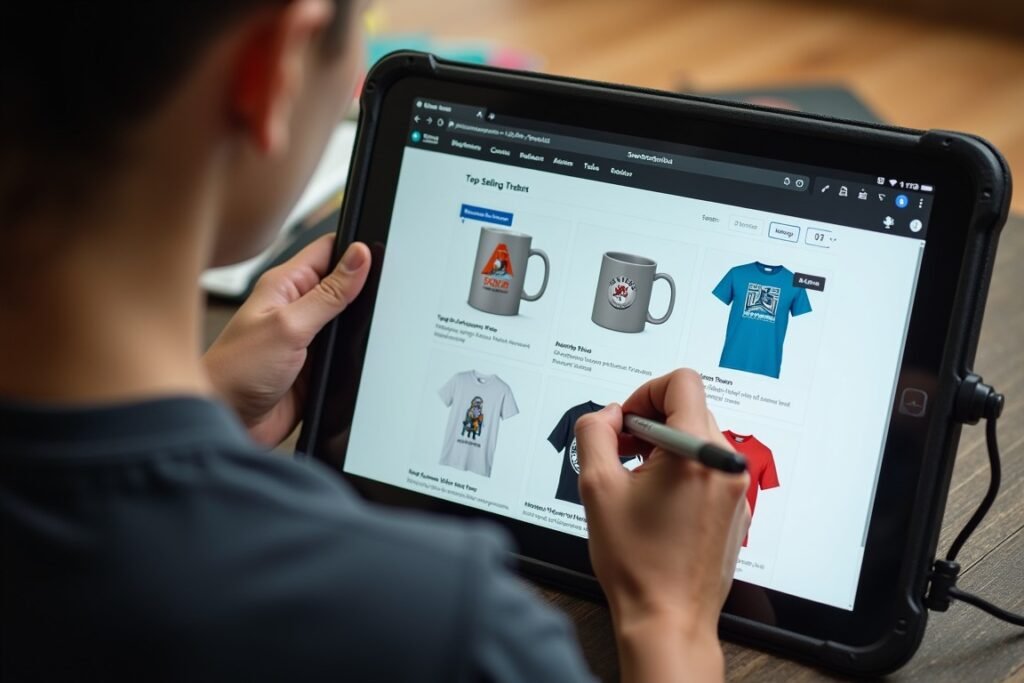

5. Sell Designs Online

Turn your design skills into income by creating custom graphics for items like T-shirts, mugs, or tote bags. Platforms like CafePress and Zazzle handle production and shipping, letting you focus on creating appealing designs.

Opportunity: Minimal upfront investment; broad market reach.

Risk: Competitive market; reliant on consumer trends.

Passive Income Ideas to Make Money for Investors

6. Invest in Dividend Stocks

Dividend-paying stocks offer you regular payouts based on the company you choose for profits. By reinvesting dividends, you can compound your payout earnings over time. Look for companies with a history of stable dividend payments to ensure consistent returns.

Opportunity: Passive income with growth potential through reinvestment.

Risk: Market fluctuations can affect payouts.

7. Build a Bond Ladder

A bond ladder requires buying bonds with staggered maturity dates. This strategy reduces reinvestment risk and ensures a steady income stream over the years. Focus on high-quality bonds for better security.

Opportunity: Predictable income with reduced risk.

Risk: Lower returns compared to stocks; interest rate risk.

8. Open a HighYield Savings Account or CD

Online banks often provide higher interest rates on savings accounts and certificates of deposit (CDs). These options offer a virtually risk-free way to earn passive income while keeping your capital safe.

Opportunity: Guaranteed returns; easy to set up.

Risk: Returns may not be the same with inflation.

9. Set Up an Annuity

Annuities offer regular payouts in exchange for an upfront investment. They can be tailored to provide lifetime income, ensuring financial stability in retirement.

Opportunity: Reliable income source; customizable payment options.

Risk: High fees and limited liquidity.

10. Try PeertoPeer Lending

These Platforms like LendingClub and Prosper allow you to give loan money directly to borrowers. You earn interest as the loan is repaid, making this a viable passive income option for those willing to take calculated risks.

Opportunity: Potentially high returns.

Risk: Borrower default risk.

11. Invest in a Municipal Bond Closed End Fund

Municipal bonds are a tax-efficient way to earn passive income while supporting public projects. Closed-end funds amplify returns by leveraging investments in these bonds.

Opportunity: Tax advantages and steady income.

Risk: Interest rate sensitivity and borrowing risks.

12. Invest in Preferred Stock

Preferred stocks combine features of bonds and equities, offering higher dividend payouts. They’re a reliable choice for income-focused investors.

Opportunity: Attractive payouts; relatively stable returns.

Risk: Limited growth potential compared to common stocks.

Real Estate Based Passive Income Ideas

13. Rental Properties

Owning rental properties can generate steady income, but success requires careful planning and property management. Optimize your returns by choosing locations with strong rental demand.

Opportunity: Long-term income and asset appreciation.

Risk: High initial investment; ongoing maintenance costs.

14. Real Estate Crowdfunding

Crowdfunding platforms let you invest in real estate without owning property directly. This approach offers diversification and lower entry costs.

Opportunity: Passive exposure to real estate profits.

Risk: Limited control over investments; platform risks.

15. REITs (Real Estate Investment Trusts)

REITs allow you to invest in real estate portfolios managed by professionals. They’re publicly traded, making them accessible and liquid.

Opportunity: Regular dividends; minimal management effort.

Risk: Market volatility affects share prices.

16. Rent Out Your Home Short-Term

Platforms like Airbnb let you monetize unused space in your home. This is a flexible way to earn income with minimal effort.

Opportunity: Quick setup; high earning potential in popular areas.

Risk: Requires maintenance and hosting effort.

Which Passive Income Source is Best?

Choosing the best passive income source is a deeply personal decision shaped by your unique circumstances, such as financial resources, interests, skills, and available time. Keywords like Passive Income Ideas play a pivotal role in shaping this decision.

Passive income streams come with varying levels of difficulty and rewards. Lower barriers to entry often result in crowded markets, reducing success rates. Therefore, it’s essential to balance opportunity size, required effort, and your inherent skills. Passion and natural ability in a specific niche can be the driving force during the challenging initial stages. Whether you have capital to invest or are starting with nothing but your time and expertise, there are **Passive Income Ideas** tailored to your situation. This section encourages readers to weigh their options carefully, aligning their strengths with the opportunities that resonate most.

How Can I Make Passive Income With No Money?

Starting with little or no money might seem daunting, but it’s a realistic avenue when you leverage time and personal expertise. Passive income sources in this category often require upfront effort rather than financial investment, making them accessible to beginners. Passive Income Ideas for those without money include:

- Building expertise: Turn skills like design, writing, or coding into valuable services or products.

- Creating digital content: Launch an online course, write an eBook, or develop a blog.

- Establishing a social presence: Grow an influencer profile on platforms that align with your passions.

While capital may be limited, consistent effort and time investment can gradually yield financial returns. This section highlights that with dedication, even those starting from scratch can unlock lucrative Passive Income Ideas.

How Can I Make Passive Income With Money?

When you have money to invest, your range of Passive Income Ideas significantly expands, offering opportunities that demand less effort but yield consistent returns. Examples include:

- Dividend stocks and REITs: Generate ongoing income through dividends, benefiting from both regular payouts and potential capital appreciation.

- Bonds and CDs: These options provide fixed, predictable income with minimal risk, ideal for those seeking a hands-off approach.

- Real estate investment trusts (REITs): Invest in real estate without the hassle of property management, benefiting from dividends and portfolio diversification.

Combining financial capital with strategic time investments can further amplify returns, especially in niche opportunities that blend effort and monetary resources. This section reinforces that Passive Income Ideas are scalable and diverse, accommodating various levels of capital and effort.

How Many Income Streams Should You Have?

The number of income streams you maintain should align with your financial goals and current resources. Diversifying income sources is a foundational principle of effective wealth-building, ensuring stability and long-term growth. As Greg McBride puts it, “You’ll catch more fish with multiple lines in the water.”

Begin with a few manageable Passive Income Ideas and expand as your resources grow. Striking the right balance is crucial—new ventures should complement, not distract from, your existing streams. Whether it’s through rental properties, investment portfolios, or small business ventures, diversifying ensures resilience and financial security.

Passive Income Ideas for Beginners

For those new to passive income, simplicity and accessibility are key. Here are some beginner-friendly Passive Income Ideas:

- High-Yield Savings Accounts: An effortless way to earn interest on your savings, this option offers a low-risk introduction to passive income.

- Certificates of Deposit (CDs): Locking funds in CDs can yield slightly higher returns compared to traditional savings accounts, though it comes with reduced liquidity.

- Real Estate Investment Trusts (REITs): Ideal for those interested in real estate but hesitant about hands-on management, REITs provide dividend-based income and portfolio diversification.

These options allow newcomers to dip their toes into the world of passive income, building confidence while earning modest but steady returns. This section ensures that beginners can explore Passive Income Ideas without feeling overwhelmed.

FAQs

Q. What is the best passive income ideas to make money for beginners?

A. For beginners, starting with low-risk options like “high-yield savings accounts”, “dividend stocks”, or “peer-to-peer lending” is recommended. These ideas require minimal expertise and provide a steady income stream. Once comfortable, you can explore more advanced strategies like “rental properties” or “creating digital products” such as e-books or apps.

Q. How much time and money do I need to invest upfront?

A. The time and financial investment vary depending on the passive income idea. For instance:

- Writing an “e-book” or starting a “blog” may require more time upfront but little money.

- Investing in “dividend stocks” or “real estate crowdfunding” needs significant capital but less time.

Evaluate your resources and goals before choosing a strategy.

Q. Are passive income streams truly “hands-off”?

A. While passive income ideas to make money are designed to require minimal effort after the initial setup, they often involve periodic maintenance. For example:

- Rental properties need upkeep and tenant management.

- Blogs and YouTube channels require consistent content updates.

The key is to automate processes wherever possible and optimize for efficiency.

Q. What are the risks of passive income investments?

A. Each passive income ideas to make money has associated risks, such as:

- Dividend stocks: Market fluctuations may affect payouts.

- Rental properties: High maintenance costs or vacancy periods.

- Peer-to-peer lending: Borrower defaults.

To minimize risks, diversify your income streams and research each option thoroughly.

Q. How long does it take to see results from passive income strategies?

A. The timeline for earning passive income depends on the strategy:

- High-yield savings accounts provide returns immediately.

- Blogs, YouTube channels, or apps may take months or even years to generate significant income.

Consistency, patience, and strategic planning are key to building a sustainable passive income.